Fire Your Budget! Master Cash Flow Instead

“Budgeting”, everyone's favorite word. Let me guess, you immediately think of a severely restrictive practice of pinching every penny. “I can’t spend any more on food this month, I’ve already hit my budget, so I guess I’ll starve.”

But it doesn’t have to be this way! And frankly, we think it shouldn’t be this way. Your life isn’t static, and your money management system should be flexible enough to adapt to the ever-changing situations in your life. Use cash flow monitoring as an alternative to budgeting.

What is Cash Flow?

Cash flow is one of the main pillars of financial planning and financial independence. As the name suggests, it simply tracks the flow of cash – income and expenses – over a period of time (typically a month, a quarter, or a year).

Obviously, the goal is to have more income than expenses in any given period, but that’s not always the case. Between unexpected events and lifestyle creep, it’s not uncommon to have some periods of negative cash flow. In fact, I’d be brave enough to guess that a substantial amount of people regularly experience periods of negative cash flow. Are you one of them?

Why is Cash Flow Important

How can you know where all your money is going if you’re not tracking it?!

Cash flow is important because it tells you how much “extra” money you have every period, or how much money you lose each period. If you have a negative cash flow, you’re either increasing your debt or decreasing your savings, neither of which is good for your long-term objectives.

If you have goals of saving for retirement, buying a house, caring for your parents, sending your kids to college, or taking an exotic vacation, you need money to do that. Your cash flow will tell you how much you have to save for these goals and will help estimate how long it will take for you to achieve them.

How much can you afford to save and invest each month? No one knows if you’re not tracking your cash flow!

What We Recommend

For existing and prospective clients, we always suggest a cash flow monitoring system opposed to a budget. Partially because the word “budget” is icky, but primarily because it’s imperative to know where you stand.

There’s no shortage of apps and technology-based systems that can track this for you, but we prefer, and recommend, the good old-fashioned manual entry. This demands your attention on a daily or weekly basis, and allows you to see the results in real-time, so you can make necessary changes before it’s too late.

Don’t get me wrong, using the apps is better than nothing, but if you’re not monitoring this regularly, it’s too easy to go overboard. And, let’s be honest, how often are you going to check the app anyway?

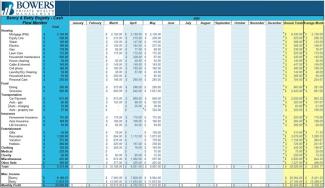

We recommend using a basic Excel (or Sheets or Numbers) document. Create a tab for each calendar year, and have each month listed on each tab, along with your regular income and expense categories.

If you want to get really fancy and have some fun data points to review, you can have your monthly averages and yearly totals tallied up in each category. Not only does this provide a good “shock and awe” statistic at the end of the year, but it helps to set your expectations for the next year. It also makes it easier to compare different years and see how inflation is affecting you.

Best Practices

Any new habit takes time to evolve, unless it’s a bad habit, those somehow manage to take hold immediately. However, the first step is simple – create a cash flow monitoring template. If you don’t know how or don’t have any skills with spreadsheets, you can find a basic cash flow spreadsheet template online and edit the categories. You can also reach out to us, and we’ll send ours to you for free.

Next, just start where you are. Don’t wait until the end of the month or beginning of the month, just start today. And don’t worry about back tracking to the first, just start with today. Keep it simple, and it will be easier to keep up with.

Now, set a calendar reminder in your phone to update this every day or once a week. I find it easiest to do in the morning, as banks and credit card companies typically update over-night.

Finally, this should only take 2-3 minutes per day, nothing crazy. Just log in to your bank and credit card accounts, look at yesterday’s transactions, and put them into the spreadsheet. You can get this completed while you’re eating breakfast, lying in bed, or sitting on the toilet. Don’t go looking for excuses, just get it done.

I like to wait until everything posts to my account before updating the cash flow monitor, but you can update as you make purchases too. Pumping gas? Have your phone out and type in the number once you replace the nozzle. It takes 2 seconds.

Pay Attention to the Numbers

This should go without saying, but I know it doesn’t so I’m going to say it: pay attention to the numbers each time to open the sheet! This doesn’t have any impact if you’re not aware of what’s going on, just blindly entering numbers.

The first three months or so should just be focused on building the habit. Once you accumulate three-months' worth of data, now you should start to analyze. Ask yourself: Where am I spending my money? Am I wasting money on things I don’t need? Do my spending habits align with my beliefs and my goals? Am I spending more than I make or barely scraping by?

Look for red flags and opportunities. If you’re wasting money on meaningless “things”, think about why you’re buying those in the first place, and work to direct that money toward something that will have a bigger impact on your life. Most spending is emotionally or behaviorally driven, so it’s important to understand why you buy things you don’t need. That way you can address the cause and not just the symptom.

Improve your financial independence and stop living paycheck to paycheck. We’ve seen people in all income levels living paycheck to paycheck. Some are even relying on high-interest credit card debt to support their lifestyle.

They all “think” they do okay managing their money, and they have a good “feel” for what they spend and what they need. But they can’t seem to get out of this endless cycle. Some only make $50 grand per year, while others are making over $800,000 and still struggling to make ends meet!

Vastly different incomes but the same financial struggles. Does this sound like you?

Understanding your cash flow is imperative for those who want to attain financial independence, and monitoring your cash flow is the best way to understand it. I’m not saying this is a guaranteed way to get you there, but it’s definitely a heck of a good start.

If you’re someone who “makes good money” but you can’t figure out where it all goes, start monitoring your cash flow today. If you need help getting things under control, use the Calendly link below to get a free introductory meeting scheduled with us.

If you’d like a free copy of our Cash Flow Monitor Excel spreadsheet, email clientservices@bowerspwm.com with your request.

– Next Blog

Previous Blog –