Understanding Portfolio Performance: Why Your Returns May Differ from the Market

The Role of Financial Planners:

As financial planners, we often encounter a common misconception that our role is to "Beat the Market." Our response to this is best summed up with the following quote from Charlie Munger – “The world is full of foolish gamblers, and they will not do as well as the patient investor.”

Our primary objective is to provide financial advice and develop personalized financial plans to safeguard your assets and guide you towards your long-term financial goals, all while considering your unique circumstances and risk tolerance. The asset management piece of a financial plan is merely a portion of an overall plan but is also considered all the way down to the individual account level based on the purpose of each account.

Today, we'll address some questions we've received about portfolio performance compared to the S&P 500 and shed light on our investment strategies.

The Power of Diversification:

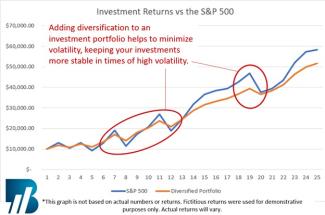

When managing investments for our clients, we adopt a diversified approach. This means investing across multiple market sectors, geographical regions, and security types like stocks, bonds, REITs and other tax-advantaged alternative assets where appropriate. The goal is to maximize returns while minimizing risk, tailored to each investor's comfort levels. The beauty of this approach lies in the fact that these strategies are most often not highly correlated, meaning some investments may go up while others go down. This is designed to significantly reduce risk, leading to more stable investment performance.

The S&P 500 vs. Diversified Portfolio:

The S&P 500, a well-known index, represents 500 large U.S. companies listed on exchanges. Although it offers some diversification through different companies, it heavily leans towards specific market sectors and is tied closely to the U.S. economy. While the index has historically performed well, it has also experienced significant volatility, which may not suit every investor. Furthermore, it isn't an ideal benchmark for comparing the performance of a diversified portfolio.

Our Holistic Approach:

At Bowers Private Wealth Management, our primary goal is to help our clients achieve their short, medium, and long-term objectives. Pursuing the highest possible returns may expose investments to excessive volatility, which could hinder investment goals at crucial times. Instead, we focus on a multi-pronged approach, including personal behavior, consistent investing and saving, tax planning, risk management, and asset location as well as allocation strategies. This helps clients reach their goals with greater confidence and ideally experience less risk and volatility along the way.

Building Disciplined Habits:

By considering multiple areas of a client's financial life and cultivating disciplined habits, we strive to achieve desired results without subjecting them to unnecessary risk. This approach helps to provide stability and peace of mind, even in unfavorable market conditions. Remember, each investor has unique objectives, risk tolerance, and financial goals. Most importantly, instead of solely comparing your portfolio's performance to the S&P 500, focus on your progress towards your desired future.

Harnessing Technology for Customization:

At Bowers Private Wealth Management, we utilize high-quality industry-specific software to create fully customized financial plans for each client. This technology also allows clients to periodically update and track their progress. While many of us crave high returns on our investments, the true measure of success lies in knowing we have a high probability of achieving financial freedom and our future goals, regardless of the current market conditions.

Conclusion:

Comparing your diversified portfolio's returns with the S&P 500 can be very misleading. Diversification aims to protect your investments and generate consistent returns over time, reducing the impact of market volatility. By understanding the inherent differences and factors at play, you can navigate your financial planning journey with confidence, while embracing the benefits of a well-diversified portfolio.

Over the past couple of decades, we have found that each client's path is unique, and optimizing your portfolio's performance requires a holistic approach. At Bowers Private Wealth Management, we're here to help you achieve your financial dreams with greater certainty. Happy investing!

*Investing involves risk including the potential loss of principal. There is no guarantee that a diversified portfolio will outperform a non -diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results.

|

– Next Blog |

Previous Blog – |