How to Live off Retirement Savings

Many people spend the majority of their adult life planning for retirement. Despite the years of saving and planning, transitioning into retirement is still a scary process for most. Working with a financial planner is a great way to help plan for retirement and ease your anxiety during the transition.

There are a variety of strategies that can be used to help ensure you make the most of your retirement savings and minimize your total lifetime tax liability. The strategy that’s right for you will depend on your personal and unique situation, as well as your goals and objectives for life in retirement.

Before you officially retire, you’ll likely want to start transitioning into a more appropriate investment strategy. You’ll still want to keep a solid portion of equities, and other growth-oriented assets, to outpace inflation, but you’ll also want some high-yielding assets and fixed income to provide income for living expenses.

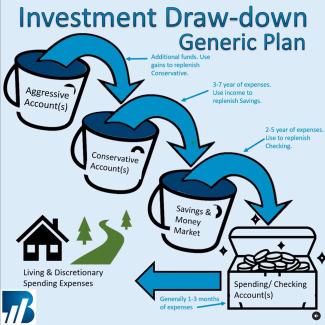

While the optimal strategy depends on your unique situation, here are a few basic and general strategies to help you live off of your portfolio.

Early Retirement:

Hopefully, if you’re planning on early retirement, you already have various investment accounts. On a basic level, most people in this position have a taxable account, a pre-tax account [either an IRA and/or 401(k)], and possibly a Roth account. Having these various account types will help to optimize your tax planning as well.

It’s generally recommended to keep 1-2 years’ worth of living expenses in a high-yield savings account as you approach this next stage in life. This account will be used to transfer funds into your checking account to cover your current living expenses. The 1-2 years of expenses in this account will ideally help prevent you from having to withdraw from your investment accounts during market downturns.

Income and/or capital gains from your taxable account can be used to replenish your savings account. Ideally, gains will be harvested at new market highs to help keep as much principal invested as possible. Retirement accounts should be left alone until you attain age 59 ½ to avoid potential tax penalties (unless you can use these early withdrawal strategies).

Depending on your current income and tax bracket, along with your expected future tax bracket, this might be a good time to consider Roth conversions. Roth conversions can help minimize future required minimum distributions (RMDs), and also reduce future tax liability. We recommend talking with your CPA and financial planner before making any Roth conversions.

After Age 59 ½:

Once you attain age 59 ½, you’re free to make withdrawals from retirement accounts without facing the 10% early-withdrawal penalty. You’ll still want to maintain a substantial level of savings in your high-yield account, but your replenishment strategy will likely be different.

If the entirety of your retirement savings are in a pre-tax account, then the strategy can be a bit more straightforward. It’s just a matter of strategically drawing down your account and considering the potential for Roth conversions.

If you have multiple account types, you’ll want to work closely with your financial planner and CPA to figure out the best way to withdraw the funds from your accounts while keeping your current and future taxes at a minimum. Your strategy will depend greatly on the number and types of accounts you have, other available assets, account balances, your goals and objectives, and other considerations unique to your situation.

You’ll also need to determine the optimal time to start receiving your Social Security benefits. Your monthly benefits generally increase about 8% every year you delay receiving the benefits. However, life expectancy and your financial needs play a big part in determining how to optimize these benefits. It’s important to remember that a portion of the benefits may be taxable depending on your income. To learn more about how these benefits are calculated, you can visit our blog How to Determine Your Social Security Benefits.

Remember, the US income tax operates on a tiered scale. The more taxable income you make, the higher percentage of income taxes you owe. It’s important to keep this in mind when taking taxable distributions, when considering Roth conversions, and when planning for future RMDs.

*Bowers Private Wealth Management and The Strategic Financial Alliance, Inc. do not offer tax or legal advice. You should always consult with your CPA, tax attorney or other tax-professional in conjunction with your financial planner.

|

– Next Blog |

Previous Blog – |

What are Roth Conversions, and Why are they such a Hot Topic? |